QuantBe currently supports NASDAQ and NYSE, with

plans to embrace new markets and asset

types.

We Now Support

Coming Soon

Everything Sounds Amazing?

Join Our Beta Today

Basic Plan

Free

Explore QuantBe's core features with

our Free Plan – a perfect start to your

trading journey.

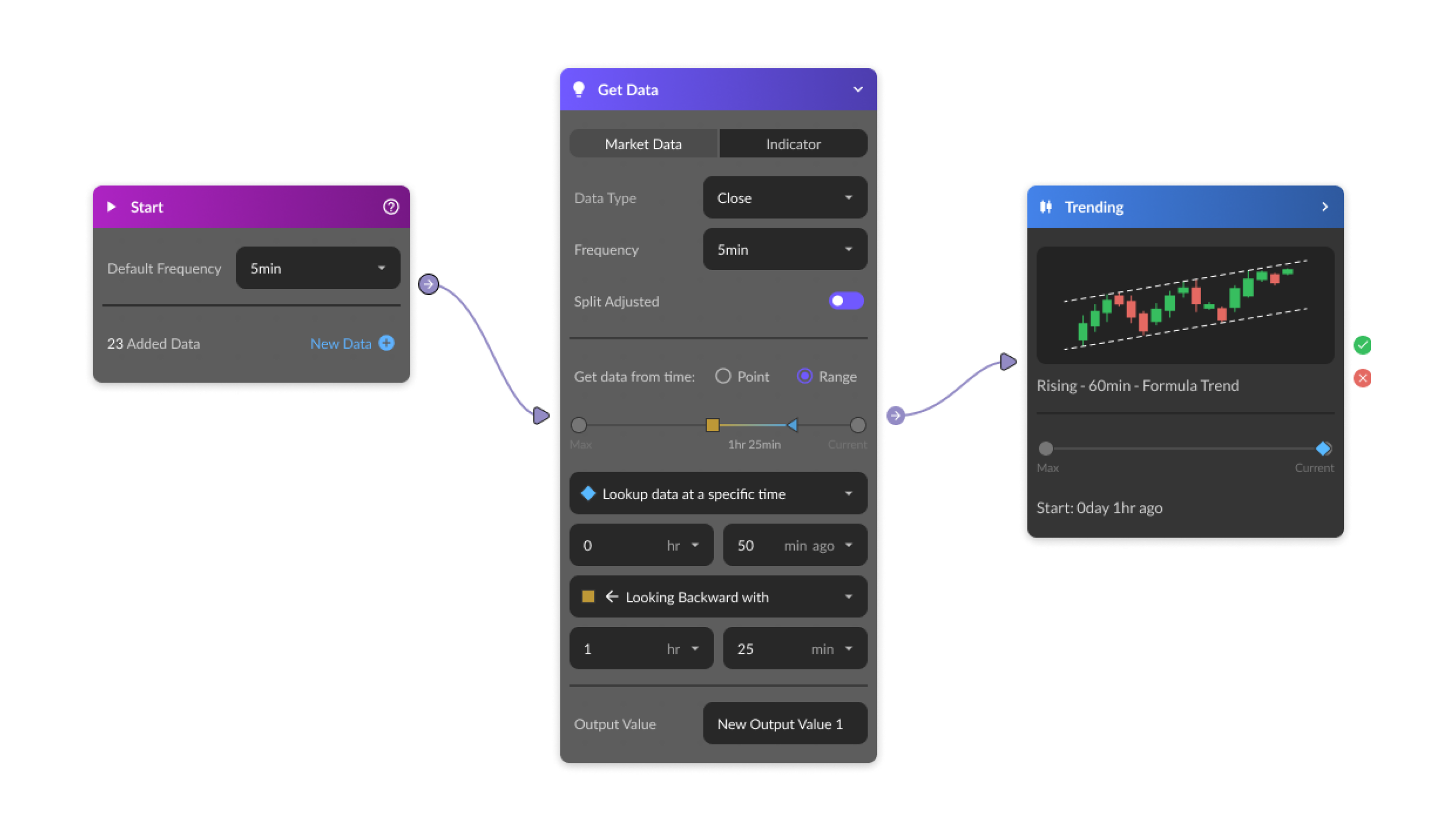

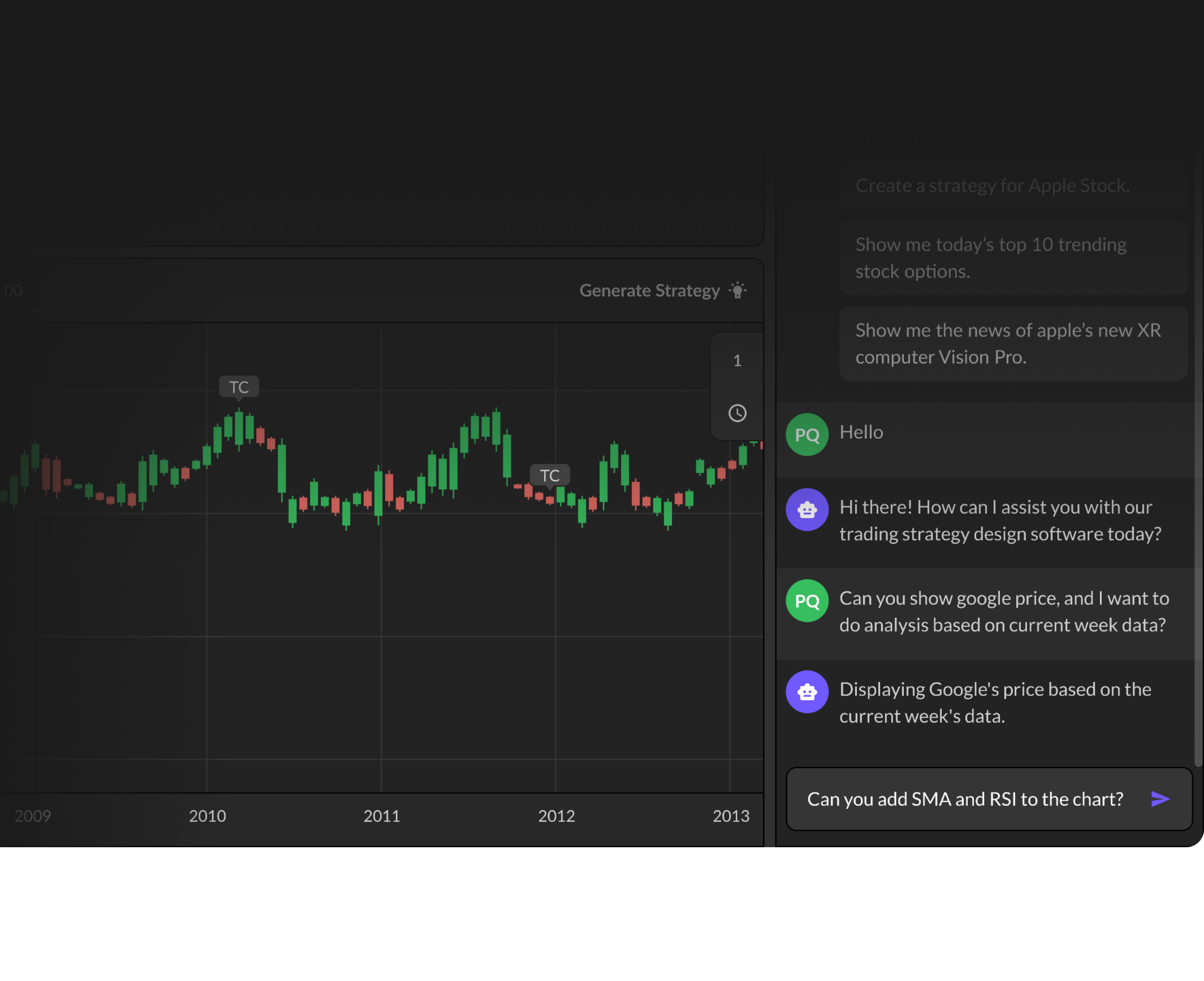

Strategy Editor

Strategy Editor

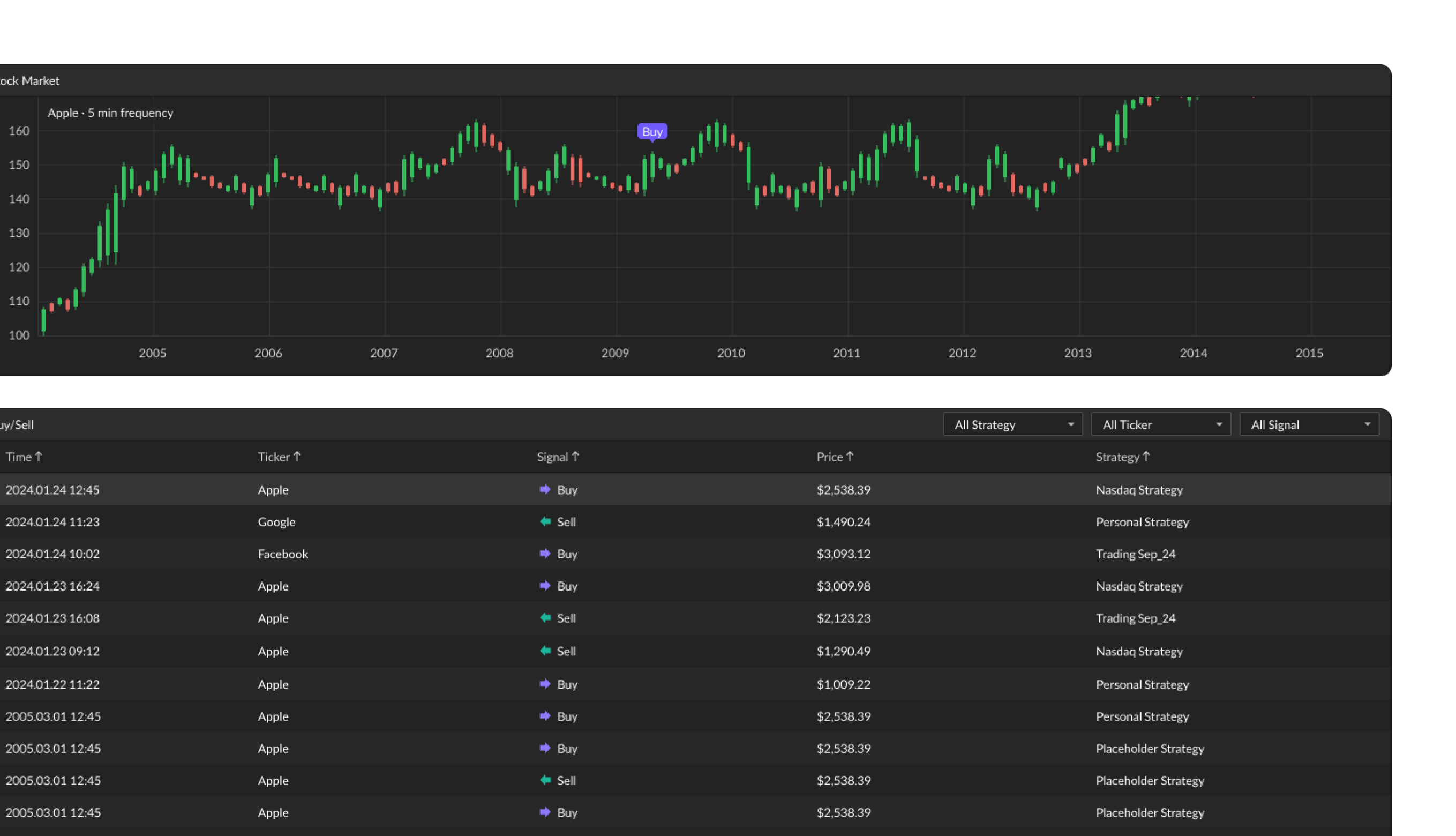

Realtime Market Data (NASDAQ & NYSE)

Realtime Market Data (NASDAQ & NYSE)

Full Indicator List

Full Indicator List

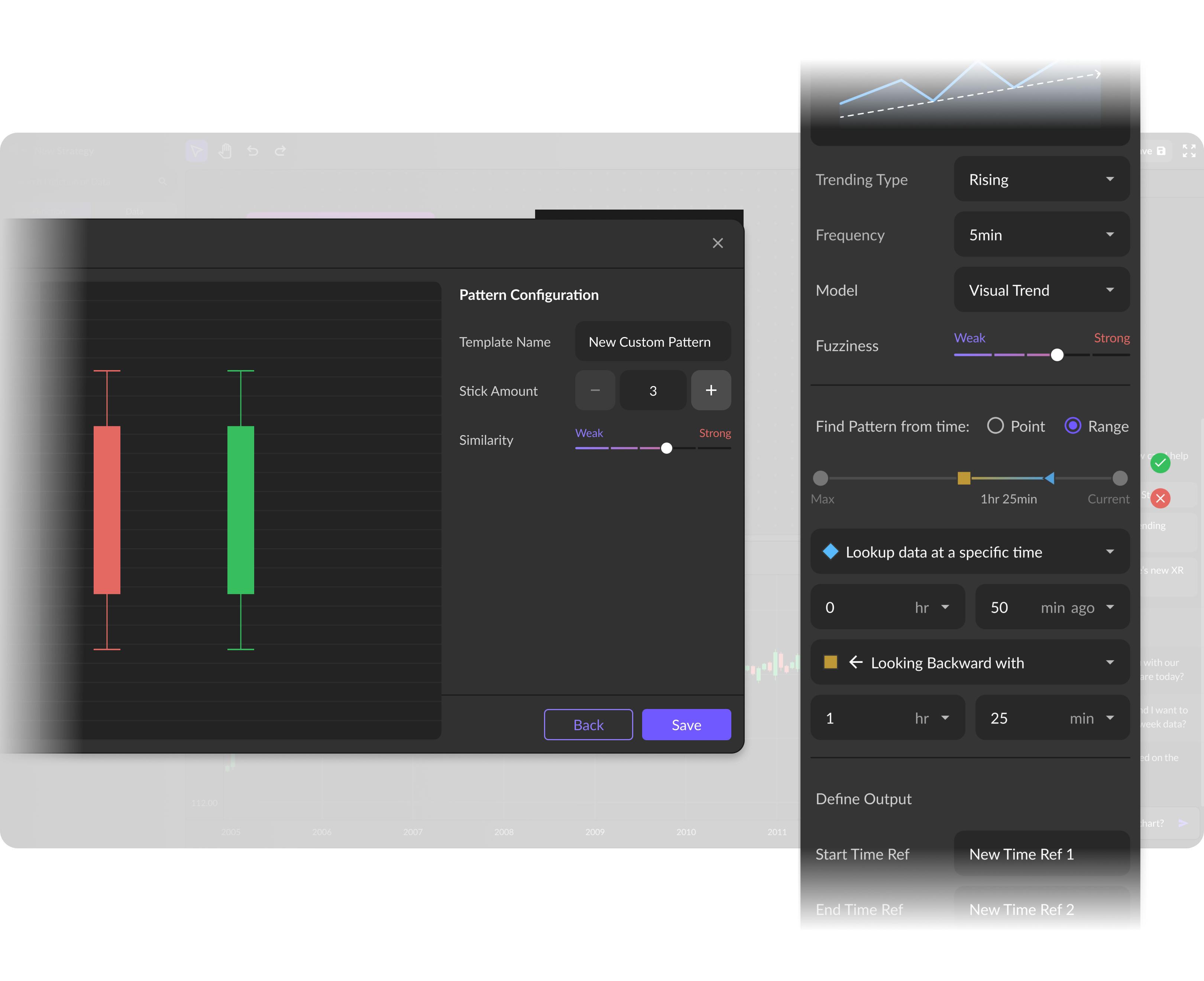

Pattern Recognition

Pattern Recognition

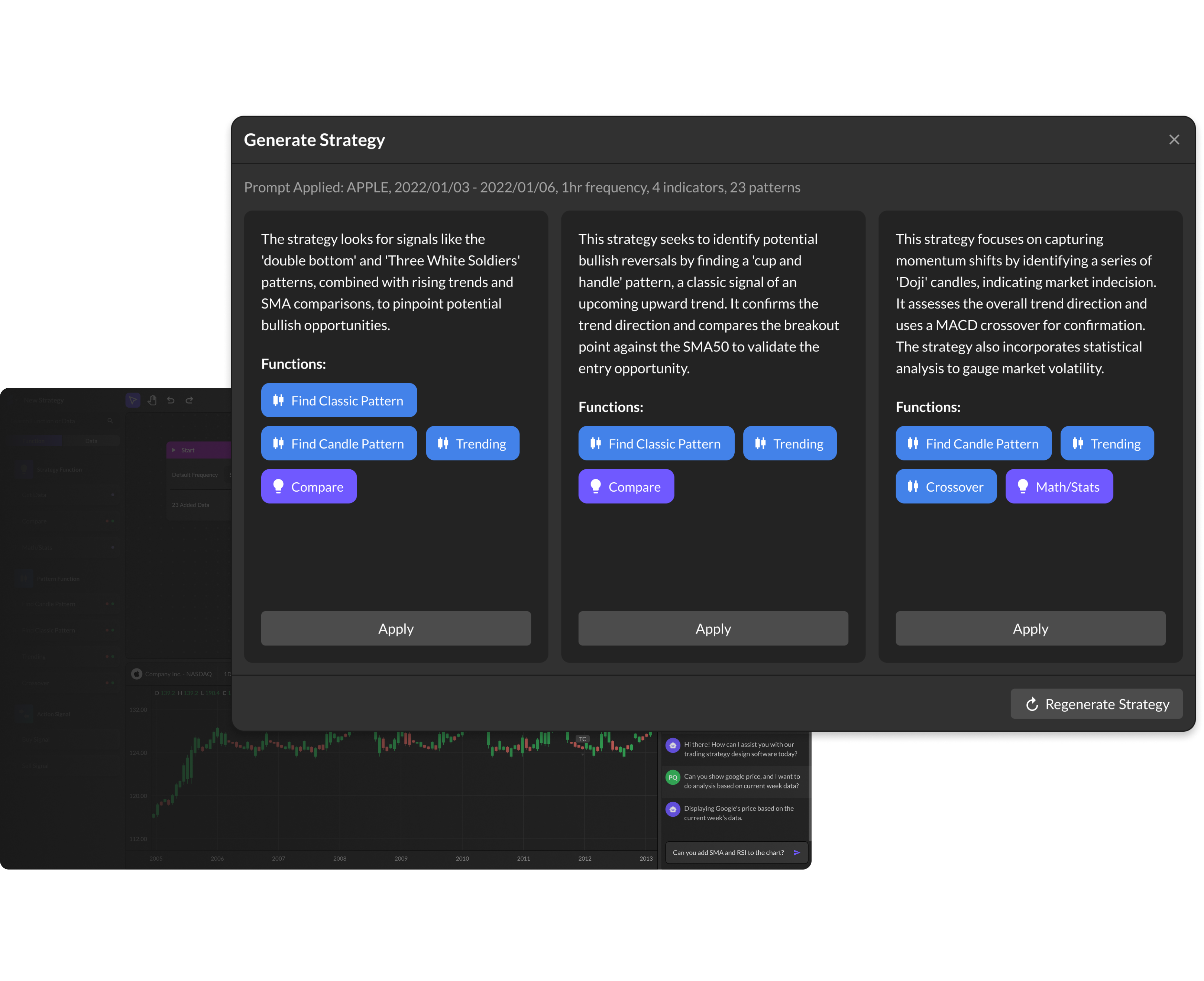

AI Features

AI Features

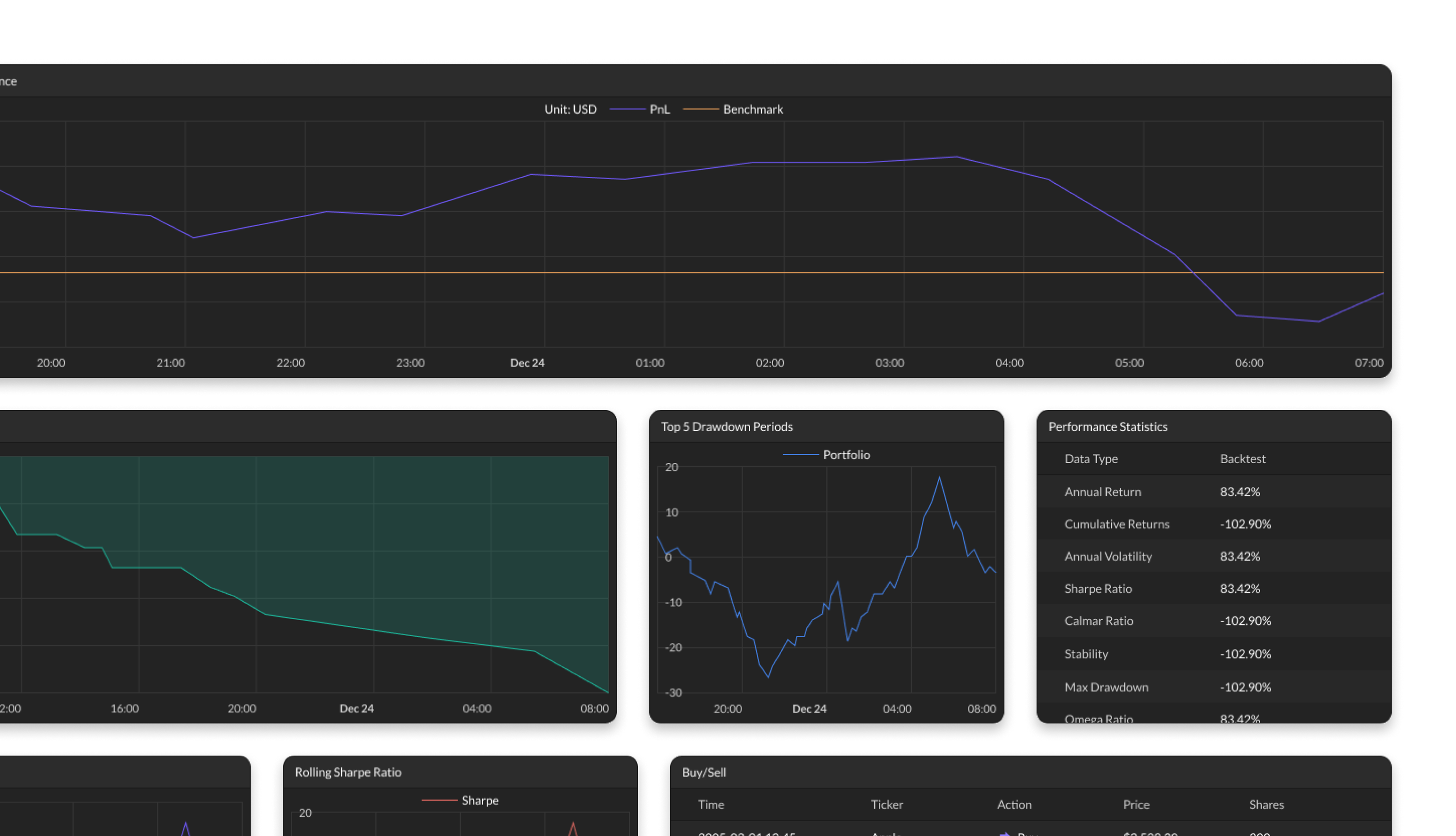

First Week Unlimited BackTest Run

First Week Unlimited BackTest Run

LiveTrading

LiveTrading

Beta Plan

$14.99 USD/Month

Introductory offer for the first 3

months, a premium plan will be introduced

in the future.

Strategy Editor

Strategy Editor

Realtime Market Data (NASDAQ & NYSE)

Realtime Market Data (NASDAQ & NYSE)

Full Indicator List

Full Indicator List

Pattern Recognition

Pattern Recognition

AI Features

AI Features

Unlimited BackTest Run

Unlimited BackTest Run

LiveTrading

LiveTrading